How To Eliminate Tax Risk From Your Retirement Plan

Taxes are one of the biggest wealth drains for every American. As the saying goes, there are two certainties in life… death and taxes!

We all have to pay taxes, there’s no getting away from that. However, we don’t have to pay “extra” taxes. By understanding a few simple rules for managing tax risk, you can eliminate future tax risk from your own retirement plan.

Tip: if you want to maximize your retirement income WITHOUT exposing your money to stock market volatility, then be sure to email us at info@ritchieadvisorygroup.com for our tried and true blueprint!

There’s one big question that I want you to keep in mind while reading this article. Ask yourself this question now, and then ask yourself again at the end. Where do you think tax rates are heading in the future… up or down?

Now, let’s discuss a few things that might help you answer that question, and why knowing the answer is so important if you want to pay less in taxes.

Tax Rate History

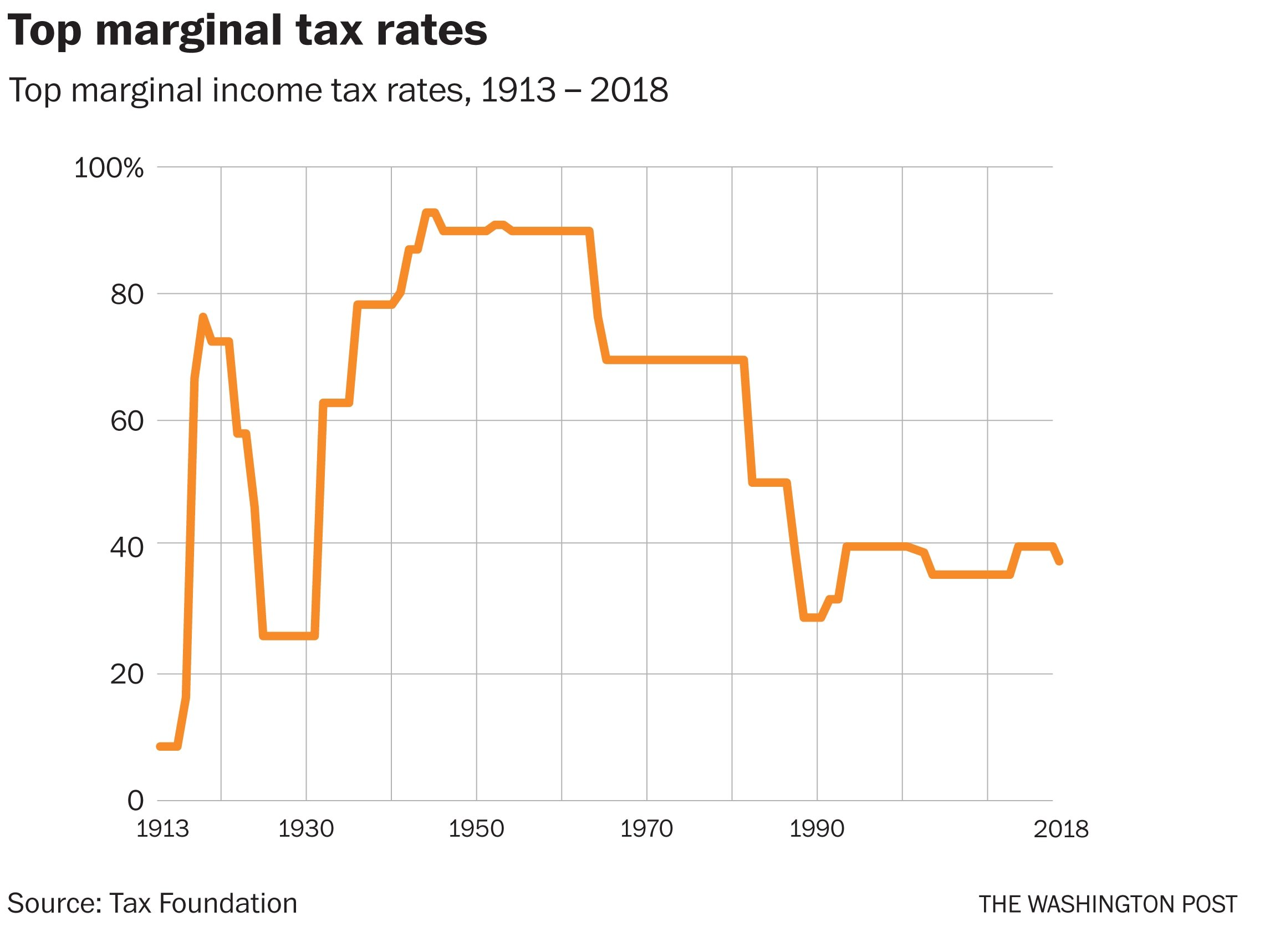

Federal income tax, as we know it today, was created back in 1913. In the first 3 years, the top marginal tax bracket was just 7%, on incomes of $500,000 or more. Those low rates didn’t last very long of course, and we’ve never been close to those low rates again. In fact, just a few years later, the highest marginal tax bracket was 77%!

Fast forward to 2022, and the highest marginal tax bracket is 37%. Now, that still sounds like a pretty high number, right? However, this is nothing compared to the highest marginal tax bracket in history, which is 94%!

Looking back at these historical tax rates can teach us a valuable lesson. If they’ve been extremely high before and have also increased so quickly at times, then why can’t that happen again? This makes tax governance a very important part of your overall retirement plan.

Every so often, something happens in the world that triggers a dramatic increase in tax rates. Could the next global pandemic, war, or natural disaster prompt an increase? Tax authorities can change tax laws whenever they feel it’s necessary, meaning that anything can happen, at any time. This is why we firmly believe that having a tax risk strategy in place to manage tax risk is a smart move for all of us!

The graph above shows us a timeline of what tax rates have been in the past. The current highest marginal tax bracket is actually at some of the lowest levels that we’ve seen historically. Federal income tax has been around for 109 years. In 79 of those years, the top marginal tax bracket was higher than it is today. The average top marginal tax bracket over those years is 57%. So, we are currently way below the all-time high, and quite a way below the all-time average as well.

Unfortunately, this means that there is a lot of room for rates to go up. Taking into account what’s happening in our world today, you would have to think that rates are going back up. It would be hard to find any financial professional who doesn’t agree, with some even predicting that current rates will have to double, making tax risks really important to consider!

Remember our big question to keep in mind… Will taxes be going up or going down in the future? And, how could this affect YOU?

Tip: learn which retirement risks are most likely to affect your retirement plan and how to avoid them, by emailing us at info@ritchieadvisorygroup.com!

The National Debt

Did you know that as of January 2022, the U.S. national debt increased to over $30 trillion?! (Technically, even higher with unfunded liabilities such as Social Security and Medicare.)

Now, it’s easy to move past that number without fully recognizing just how big it really is. Imagine $1 billion, then imagine that again 30,000 times over. To look at it from another perspective as well… if you were to go back in time by 1 million seconds, it would take you back to nearly 12 days ago. If you were to go back in time by 1 trillion seconds, it would take you back to nearly 32,000 years ago. So, there’s a big difference between a million, a billion and a trillion. Again, our national debt is currently over $30 trillion!

At the end of 2019, the U.S. national debt was around $23 trillion. Which means $7 trillion has been added in just the last two years alone. This is a huge concern for all of us because the government has a very quick way to raise money if they need to… and that way is to simply raise taxes. Remember, the top marginal tax bracket has previously been as high as 94%!

At this point, what are your thoughts on whether taxes are likely to go up or go down in the future? (By the way, I think I may know your answer!)

Why is tax risk such a big problem?

Most people have their retirement savings in traditional retirement accounts, like 401(k)s, IRAs, etc. These are tax-deferred accounts! That means that a tax deduction is taken on the front end, so therefore taxes have to be paid on the back end (in retirement). You’ll have to pay taxes on the whole retirement account, which includes the money that you’ve put in and also any gains that it’s earned over the years. It’s vital that tax risk management is done correctly and legally, as we’ve all heard of public figures that get involved in tax disputes or even charged with tax evasion (and we don’t want to be in their shoes)! But we are allowed to avoid paying any additional taxes that are above and beyond what is legally required.

How do you feel about not knowing what the tax rate will be when you retire? If you don’t know what the tax rate will be, then how can you calculate how much you’ll owe in taxes? You’re actually growing your money in a retirement account where you have no idea what you’ll be able to take out. And that doesn’t sound like the safe and secure retirement plan that most people are looking for!

So, to answer the question: how could higher taxes in the future affect you?

When the tax train comes, it could be devastating for anyone who has their retirement funds in a tax-deferred account. They are basically sitting on a tax time bomb. These accounts are at the mercy of our government and whether they wish to increase taxes or not. You could lose half of your retirement nest egg just on paying taxes alone! This is why tax risk is such a big issue that needs to be managed correctly. Understanding tax legislation when managing tax issues is vitally important, as you have to make sure that tax compliance is adhered to.

Tip: read this article to continue learning about the top 10 retirement planning risks and how to eliminate them. A popular section within the article discusses how to avoid market risk.

How do I eliminate or reduce tax risk?

After reading all that doom and gloom about managing your tax affairs, you’ll be glad to hear that we do have some good news for you! We like to offer solutions to the financial problems that we discuss. So, here we go:

1. You could build your wealth in a completely tax-free account, so that you don’t have to worry about higher taxes at all. Even if tax rates go up to 90%, it doesn’t matter, because a 90% tax rate won't affect your tax-free retirement account, you’ll still pay $0 in taxes!

2. At a minimum, you should probably consider tax diversification. You can build your retirement nest egg by using multiple accounts, some tax-free, and some tax-deferred. While reviewing your overall financial picture (looking at bank accounts, any balance sheet total, asset breakdowns, etc.), it’s a great time to asses how diverse your accounts are.

3. You could also consider a combination of step 1 and step 2. There are 3 tax buckets that your money will fall into (taxable, tax-deferred and tax-free). There is a strategy to use where people can have money in all three buckets and still work towards a 0% tax bracket in retirement!

After learning about how high our national debt currently is, and how high tax rates have been in the past, let’s finish on the same question that we started with… Where do you think tax rates are heading in the future? And, how much could this affect your retirement plan?

If you think that tax rates will be lower, then tax-deferred accounts might be best for you. If you think that tax rates might be higher, then tax-free accounts might be best for you. We have all of these options available, so you can schedule a free retirement consultation today and we’ll help you decide which strategy might be best for your own retirement plan.